Coronavirus Stimulus Plan Update

Negations between the Trump administration and Congress has yielded a stimulus package worth more than $2 trillion in spending and tax breaks to help American families – and corporations, battle the Coronavirus pandemic. But many are still curious as to what the package will include, and if it will benefit millions of taxpayers. Here are some of the key points you need to know.

Who Benefits From The Plan?

Large Companies and Corporations

The plan will include $500 billion in loans and assistance to large corporations, states, and cities, according to the most recent draft. Democrats insist there will be some strings attached for these companies. Corporations receiving the loan are banned from buybacks through the term of the loan, plus 1 additional year. There are also limits on executive bonuses and steps to protect workers. In a nutshell, the package will largely benefit the hotel, retail, restaurant, and airline industries. But what about oversight? Who will make sure these funds are being used to the benefit of employees working in this industries. The Treasury Department stated a new Treasury inspector general would oversee the lending program and the terms of the loan and other aid would need to be disclosed.

Airlines

Struggling U.S. airlines would be eligible to receive federal loans and direct cash assistance if they are willing to give an option for an ownership stake to the government. The program allocates $25 billion to passenger carriers and $3 billion to airline contractors providing ground staff such as caterers, while cargo haulers would see $4 billion. The addition of direct cash relief — earmarked specifically for payrolls — was sought by airline and industry unions, which feared massive job losses if loans were the only option. The S&P Supercomposite Airlines Index advanced further, rising as much as 17 percent on the day, before closing up 9.8 percent.

The legislation doesn’t include emissions limits for airplanes that were sought by House Democrats, Senator Pat Toomey, a Pennsylvania Republican, said on a press call. Other transportation winners include rail and transit operators. Amtrak would get $1.02 billion to cover coronavirus-related revenue losses and support state-funded routes. State and local transit agencies would get $25 billion for operating and capital expenses.

Small businesses

The bill carves out more than $350 billion in aid for small businesses, much of which would be in loans through the Small Business Administration and banks, guaranteed by the federal government. The loans would be forgiven provided the businesses meet certain requirements, including limiting reductions in pay and layoffs, though with more flexibility for employers than the original Senate bill.

Industry advocates previously said loans weren’t enough, especially for the smallest outfits, although some expressed more optimism on Wednesday. An instant cash injection is the only way to save them from failing, according to the Small Business Majority.

Now, the part you’ve been waiting for- Taxpayers and Self Employed

The package would provide direct payments to lower- and middle-income Americans of $1,200 for each adult, as well as $500 for each child.

Democrats were able to secure a change from a previous version that allows low-income taxpayers to get the full $1,200 payment. The initial plan would have given smaller checks, or in some cases, no money at all, to very-low income people.

Unemployment insurance payments were boosted and recipients would be eligible to receive those funds for an average of four months, up from three in the prior GOP plan. It also would extend eligibility to the self-employed and workers in the gig economy such as drivers for Uber Technologies Inc.

Money for hospitals under health-care ‘Marshall Plan’

The legislation calls for $117 billion for hospitals and veterans’ health care, as well as $16 billion for personal protective equipment, ventilators and other medical supplies for federal and state response efforts. It also includes $11 billion for vaccines, therapeutics, diagnostics and other medical needs, and at least $250 million to improve the capacity of health-care facilities to respond to medical events, according to a summary by the Senate Appropriations Committee.

Mortgage relief for wide swath of borrowers

Many U.S. homeowners and businesses hit hard by coronavirus could get relief from making their monthly mortgage payments through the bill.

Borrowers with loans insured by government agencies such as the Federal Housing Administration and the Department of Veterans Affairs would be eligible for forbearance. Consumers whose mortgages are backed by Fannie Mae and Freddie Mac would also be eligible to skip payments.

With written assistance from TruPoint Accounting & Tax and Bloomberg News

Tax Filing & Payments New Deadline – July 15th

In Notice 2020-18 (PDF), the Treasury Department and the Internal Revenue Service (IRS) announced special Federal income tax return filing and payment relief in response to the ongoing Coronavirus Disease 2019 (COVID-19) emergency. Below are answers to frequently asked questions related to the relief provided in the Notice. These questions and answers will be updated periodically and are designed to be a flexible tool to communicate information to taxpayers and tax professionals in this changing environment. The answers to these questions provide responses to general inquiries and are not citable as legal authority. Accordingly, the Treasury Department and the IRS are continuing to consider additional IRB guidance on these issues addressed in these FAQs.

4 Accounting Must Do’s for Any Business

So you’re ready to launch your online store, congratualations! It wasn’t easy, but your hard work and determination got you to where are you are today. And though you may have a clear understanding on what your business sells, you’ll need to stay on top of certain tasks in accounting to keep your store on track and meeting its milestones. Here a few quick accounting steps you need to do now.

1. Open a bank account

Shop around for the best deal on a business checking account. You’ll want to stash your business income in a separate account to not only keep track of your business income but to also make life easier come tax time. If you are an LLC, in a partnership or corporation, you are required by law to maintain a separate business account. Different business accounts have various fee structures so pay close attention to stay within your budget. You might also want to look into business credit card to establish business credit. You must first establish your business by acquiring a name, licensing and registration within your state of business.

2. Track expenses

Build a solid business foundation by learning and tracking your expenses. This will help you monitor growth as you expand. Early on, establish a system which organizes your receipts and other important records. We recommend a small separate filing cabinet or portfolio labeled by month as an easy way to stay organized. Pay extra attention to Meal & Entertainment expenses, Business travel expenses, business vehicle expenses, charitable gifts and home office expenses as you are allowed to deduct them come tax time.

3. Implement a bookkeeping system

The point of accounting is to monitor and track a businesses progress and to make sense out of all the data compiled through bookkeeping to build a financial statements. You’ll need to determine which bookkeeping method to use and choose the best one that fits your business & budget. You can choose to DIY by using software like Quickbooks, or you can choose to go old school and use Excel spreadsheets. Outsourcing a bookkeeper or accountant is the most effective way to start and stay on track. We recommend finding a local bookkeeper that can work on site or virtual.

4. Set up payroll

Many start ups are run and operated by the business owner, however, if you plan to hire employees, you need to determine if the individual is an employee or independent contractor. For employees, you’ll need to set up the payroll schedule and ensure that you are withholding the correct amount in taxes. For independent contractors, keep track on how much you payout to each individual. Independent contractors may be required to file 1099s for each year end so keep and maintain proper contractor information.

Want to learn more? Sign up to see the complete list and for more accounting and tax resources.

We Made the List! Florida’s Top 10 Accounting & Tax Firm

We’re elated to accounce that TruPoint Accounting & Tax has been chosen as one of the best Top 10 Accounting Firms in the Central Florida area for 2018! After research and validation, Expertise.com hand-picked TruPoint Accounting & Tax as one of the Top 10 Best Accounting Firms in Lake Mary and it’s surrounding areas. Expertise.com is a research company that uses proprietary research and selection software to identify top professionals in over 100 industries across 1000 cities, covering 85% of the US. They have explored and anaylzed over 10 million business that have generated $500 million in revenue for the local small business sector. Each company must meet the criterias in Reputation, Credibilty, Experience, Engagement, and Professionalism. Therefore, as Expertise.com says….a business can’t pay to be included on Expertise.

TruPoint Accounting & Tax is honored to provide outstanding qaulity work at affordable prices to all who come through our doors and we will continue to do to so for legacies to come. Thank you for walking with us, “For Every Step of the Way”.

Got Gigs? Your Gig May Be Taxable!

If you provide a services such as car rides or other shared services for income, what you earn may be taxable.

If you provide a services such as car rides or other shared services for income, what you earn may be taxable.

If you use one of the many online platforms available to rent a spare bedroom, provide car rides, or to connect and provide a number of other goods or services, you’re involved in what is sometimes called the sharing economy.

An emerging area of activity in the past few years, the sharing economy has changed how people commute, travel, rent vacation accommodations and perform many other activities. Also referred to as the on-demand, gig or access economy, the sharing economy allows individuals and groups to utilize technology advancements to arrange transactions to generate revenue from assets they possess – (such as cars and homes) – or services they provide – (such as household chores or technology services). Although this is a developing area of the economy, there are tax implications for the companies that provide the services and the individuals who perform the services.

This means if you receive income from a sharing economy activity, it’s generally taxable even if you don’t receive a Form 1099-MISC, Miscellaneous Income, Form 1099-K, Payment Card and Third Party Network Transactions, Form W-2, Wage and Tax Statement, or some other income statement. This is true even if you do it as a side job or just as a part time business and even if you are paid in cash. On the other hand, depending upon the circumstances, some or all of your business expenses may be deductible, subject to the normal tax limitations and rules.

Call us 407-362-1558 today and speak with a qualified Tax pro!

What should I include in a business plan?

If you’re starting a business, it’s always wise to consult with a firm like TruPoint Accounting & Tax which specializes in creating thorough business plans for various types of businesses. However, it doesn’t hurt to create your own basic plan as you are just getting started. This format generally serves a guide for most business plans and can be adapted to any specific type of business.

A basic plan can be broken down into five segments.

- Introduction

- Marketing

- Financial Management

- Operations

- Concluding Statement

Q: What to include in the introduction?

A: The introductory section of your business plan should give a detailed description of the business and its goals, discuss its ownership and legal structure, list the skills and experience you bring to the business, and identify the competitive advantage your business possesses.

Q: What to include in the marketing segment?

A: In the marketing section, you should discuss what products/services your business offers and the customer demand for them. Furthermore, this section should identify your market and discuss its size and locations. Finally, you should explain various advertising, marketing, and pricing strategies you plan to utilize.

Q: What to include in the Financial Management segment?

A: In this section, explain the source and amount of initial equity capital. Also, develop a monthly operating budget for the first year as well as an expected return on investment, or ROI, and monthly cash flow for the first year. Next, provide projected income statements and balance sheets for a two-year period, and discuss your break-even point. Explain your personal balance sheet and method of compensation. Discuss who will maintain your accounting records and how they will be kept. Finally, provide “what if” statements that address alternative approaches to any problem that may develop.

Q: What to include in the marketing segment?

A: This section explains how the business will be managed on a day-to-day basis. It should cover hiring and personnel procedures, insurance, lease or rent agreements. It should also account for the equipment necessary to produce your products or services and for production and delivery of products and services.

Q: What to include in your concluding statement?

A: In the ending summary statement, summarize your business goals and objectives and express your commitment to the success of your business. Also, be specific as to how you plan to achieve your goals.

Need professional business planning help? Drop us a line HERE Read More…

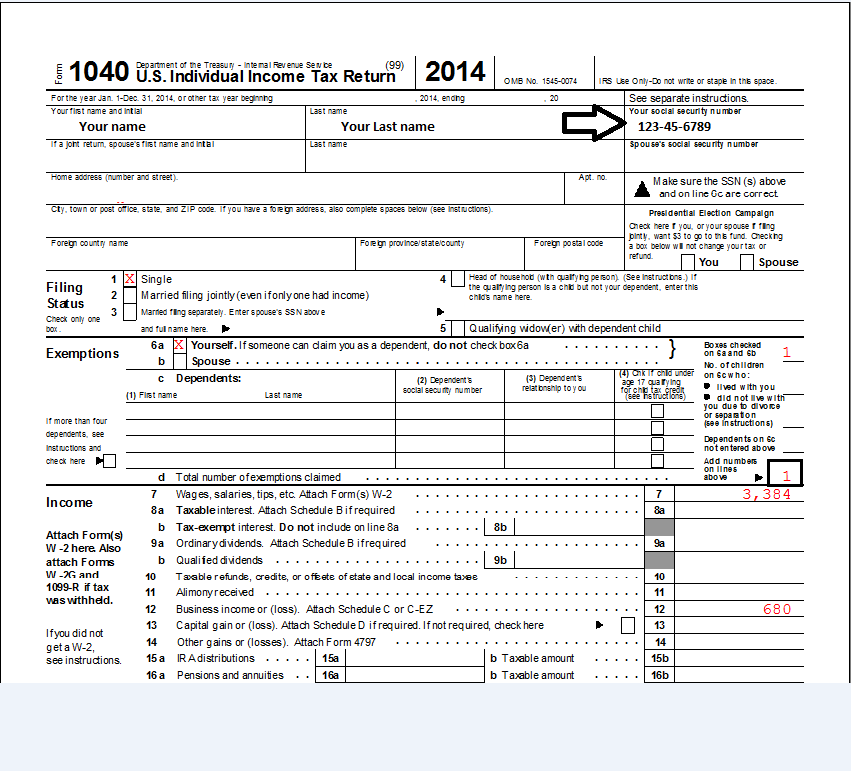

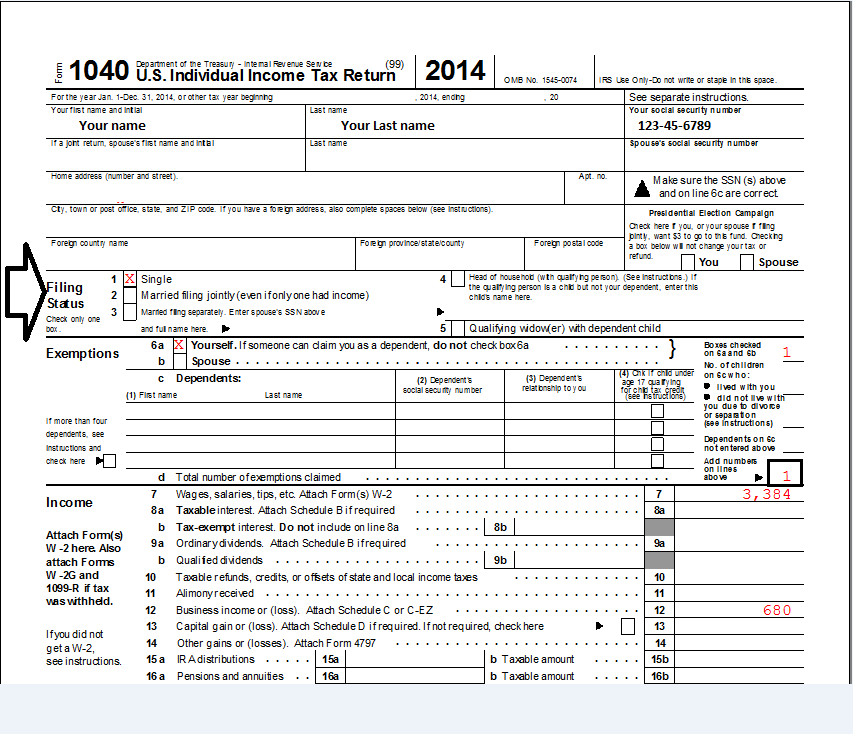

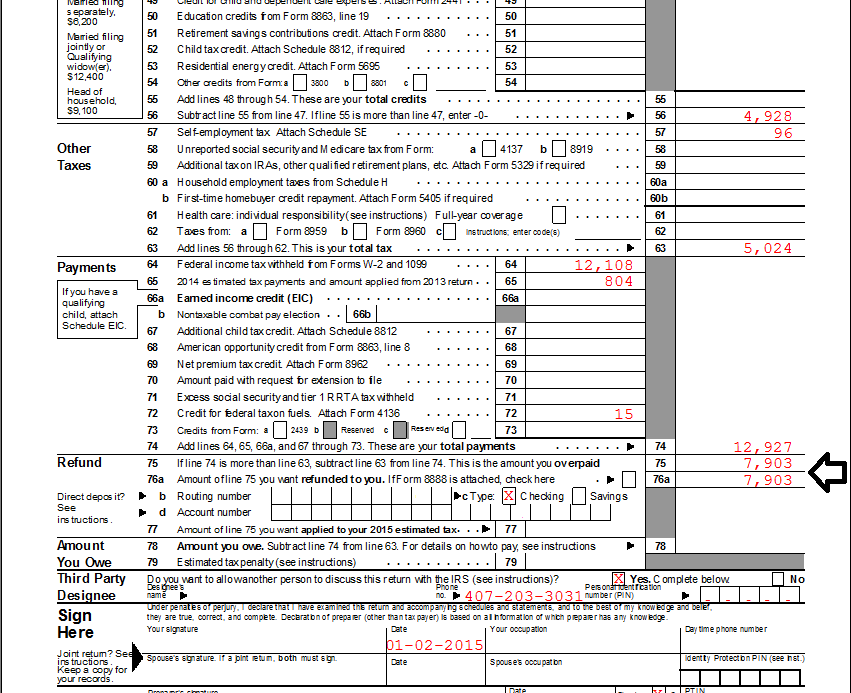

How do I check my refund status?

Where’s My Refund? – It’s Quick, Easy and Secure

What you need to check the status of your refund:

Where to find information on your tax return?

Social Security Number or ITIN

Filing Status

Exact Refund Amount

[maxbutton id=”1″]

Where’s My Refund? is updated no more than once every 24 hours, usually overnight.

When to check status of your refund:

- Within 24 hours after the IRS has received your e-filed tax return; or

- 4 weeks after mailing your paper return.

When the IRS processes your tax return and approves your refund, you can see your actual personalized refund date. Even though the IRS issues most refunds in less than 21 days after they receive your tax return, it’s possible your tax return may require additional review and take longer.

You should only call if it has been:

- 21 days or more since you filed electronically;

- More than 6 weeks since you mailed your paper return; or

- The Where’s My Refund? tool directs you to contact the IRS.