6 Important Steps To Correcting Your Financials

Don’t Let Errors Affect How You Represent Your Business

6 Important Steps To Correcting Your Financials

1. Obtain An Accounting Software To Avoid Bookkeeping Mistakes

Using an accounting software allows you to have built in checks and balance in order to avoid costly bookkeeping mistakes. Business owners should review the reporting requirements of their industry and ensure that their accounting system meets at least the minimum reporting requirements.

2. Separate Business vs. Personal Expenses

Maintaining separate bank accounts is crucial as your business continues to operate and grow. Keep all business related receipts for accounting purposes and communicate immediately to your accountant any changes in you business expenses.

3. Properly Close Your Books And Review Previous Financial Statements

Accidentally recording transactions in a prior period can be avoided by setting a year-end closing date and password to prevent changes to prior reconciled transactions. Most software’s such as QuickBooks allow you to lock and unlock in order to make adjustments. But this should be done carefully. Reviewing your previous balance sheet report should help identify if changes were made in order to properly make adjustments.

4. Check Your Financial Statements For Errors

Inputting transactions into your accounting system must be done carefully in order to have correct debit and credit balances. Asset accounts should have debit balances and liability accounts should have credit balances. To avoid incorrect balances, review the details within the accounts to ensure that the entries were posted correct and there weren’t any duplicated adjusting entries.

5. Conduct Periodic Review

Reviewing your financials periodically will allow you to catch errors earlier in order to fix in a timely manner. Scan through the expenses that were entered to ensure that they weren’t misclassified. Scan for assets that should’ve been capitalized based on your industry/company policy and make adjustments to reclassify them. Conducting periodic reviews will reduce the amount of stress of preparing your financials for tax purposes.

6. Get Help When Needed

Business owners should access their current resources and time available to keep books current and up to date. Outsourcing the accounting to a professional accountant will save you time that could be spent tending to other operational issues. Please contact our office for assistance through Live Chat, , email us at info@trupointaccountingandtax.com or give us a call at 407.203.3031.

10 Smart Ways To Spend Your Tax Refund

Did you already spend half of your tax refund in your head? What if we told you that there are far more intelligent ways and things to spend your refund on other than your usual shopping sprees and nights out? The average refund amount within the last 2 years have been around $3,000, that’s a pretty hefty chunk of change that can either make or break your year. We’ve compiled a list of the most intelligent things your tax refund can do.

1. Start a small business.

Purchasing business development services for your small business idea is a great way to put your refund to use. A proper business plan will normally run you about $500-$10K from major accounting firms. Meanwhile, Licensing and pertinent registrations can cost anywhere between $5K-$15K at a major accounting firm. TruPoint Accounting & Tax decreases that cost up to 75%. Think smarter. Keep more of your money and decrease cost.

2. Increase your savings.

This is the best time to pump a large amount of cash into your savings. Whether you’re saving up for a rainy day or a new house, we say “Act like you’ve never received a refund and save, save, save”!

3. Finish a remodeling project.

Spruce up your place by finalizing on a costly home project and have the whole year to bask in the ongoing savings. Your home improvement can qualify as a deduction if it adds materially to the value of your home; or prolong your home’s useful life significantly; or adapts your home to new uses. Chat with someone or call TruPoint Accounting & Tax today at 407.203.3031. We’ll help you find even more deductions that are allowed.

4. Buy Insurance.

This is the perfect time to get yourself, home and other liabilities covered. Monthly and yearly plans for home insurance can range around $700-$1500 per year. Life and car insurance typically starts from $50 to $300 per month.

5. Make Investments

Invest in mutual funds or stocks you’ve been considering. It may be a risk worth taking.

6. Pay off Bill Collectors

Take some creditors off your back by paying off a substantial amount of credit card debt and past due bills. This may even be the time to close any credit card account with too high of an interest rate.

7. Travel.

Put your refund on a separate account and prepay for a nice vacation rather than raking up credit card bills and dipping into your emergency fund.

8. Pursue Education.

Put money towards your education. Take a few college courses and improve your education without loans and government assistance.

9. Give back.

Help give back by donating to a local charity, school, or just someone who needs the help. It doesn’t always have to be cash. Charity in the form of food, clothing and shelter is always appreciated.

10. Splurge Intelligently! Go Green

Make a large purchase on a solar panel system for your home and save thousands of dollars in electrical bills.

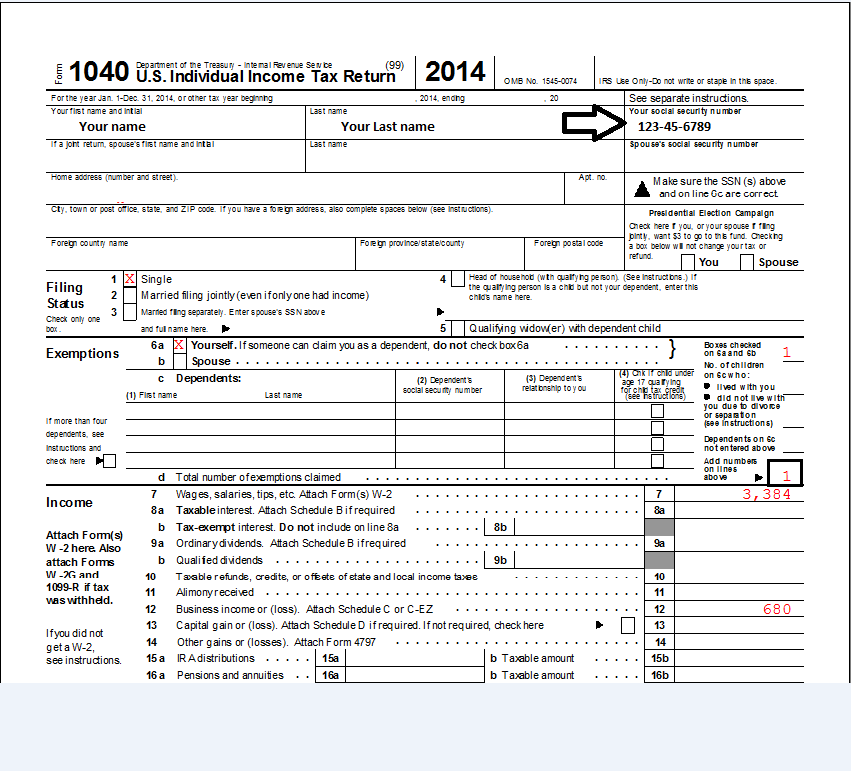

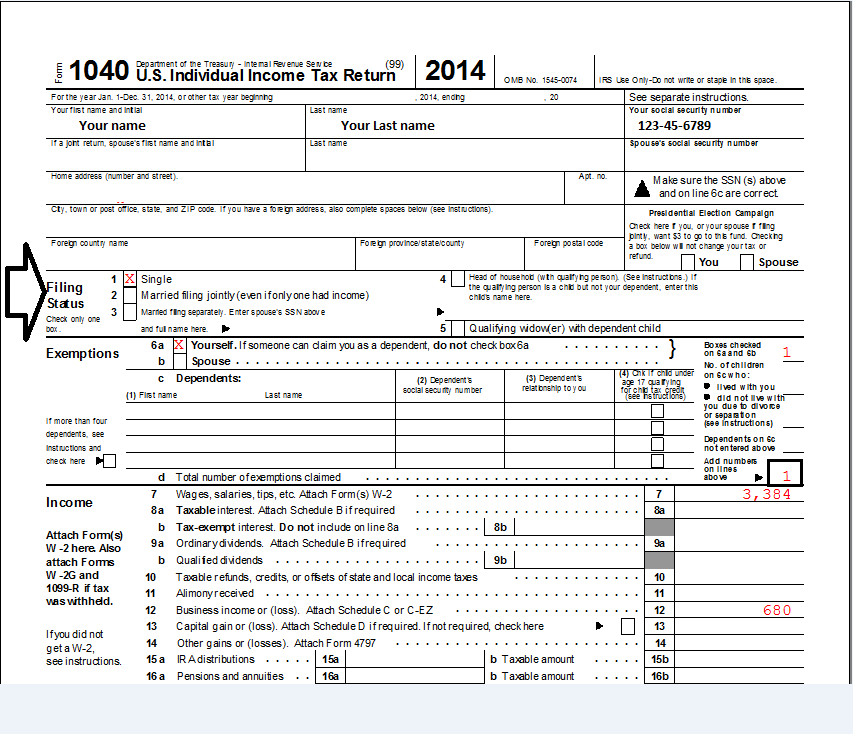

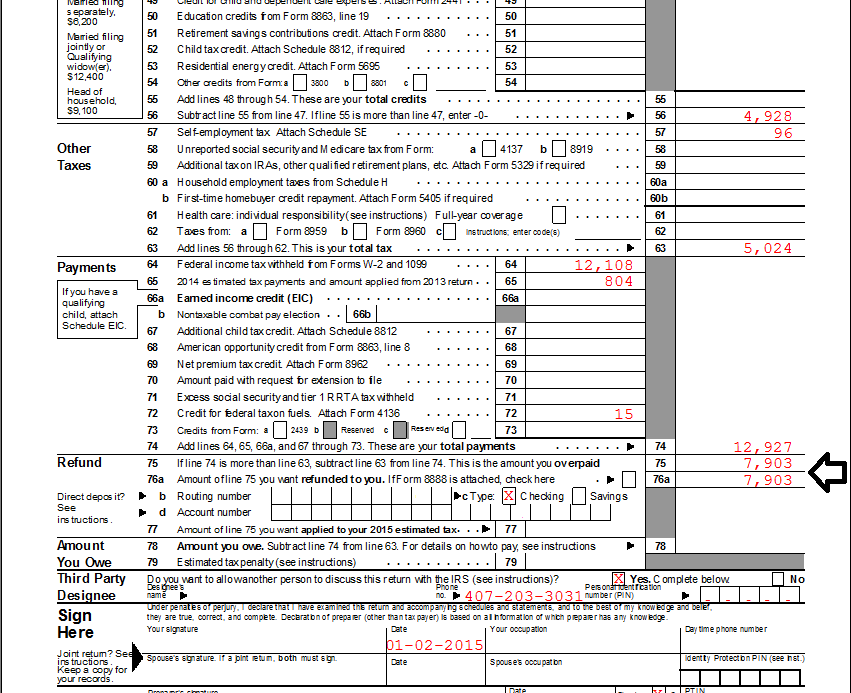

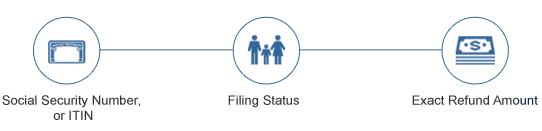

How do I check my refund status?

Where’s My Refund? – It’s Quick, Easy and Secure

What you need to check the status of your refund:

Where to find information on your tax return?

Social Security Number or ITIN

Filing Status

Exact Refund Amount

[maxbutton id=”1″]

Where’s My Refund? is updated no more than once every 24 hours, usually overnight.

When to check status of your refund:

- Within 24 hours after the IRS has received your e-filed tax return; or

- 4 weeks after mailing your paper return.

When the IRS processes your tax return and approves your refund, you can see your actual personalized refund date. Even though the IRS issues most refunds in less than 21 days after they receive your tax return, it’s possible your tax return may require additional review and take longer.

You should only call if it has been:

- 21 days or more since you filed electronically;

- More than 6 weeks since you mailed your paper return; or

- The Where’s My Refund? tool directs you to contact the IRS.

Should churches issue ministers a Form W-2 or Form 1099-Misc?

Should churches issue ministers a Form W-2 or Form 1099-Misc?

Most ministers have a “dual tax status”. Generally, they are employees for income tax purposes but are always self-employed for social security purposes with respect to their ministerial income. Ministers working for a church or church agency should receive a Form W-2. Ministers, who report their federal income taxes as self-employed on Form 1099, may face a significant risk of additional taxes and penalties, if they are audited and reclassified as employees by the IRS.

Under the latest treasury regulations, a minister is described as an employee for federal income tax purposes but as self-employed for social security tax purposes. What many minister’s often fail to consider is that when one files a 1040 tax return they are paying two types of taxes. They pay Federal Income Tax and Self Employment Tax. That makes the minister a hybrid of the tax code. Section 6051 requires the issuance of a W-2. However, because Section 3401 describes him/her as self-employed, the church is not required to withhold Federal Income Tax, FICA or Medicare taxes from their ministers’ pay, even if their ministers are employees for income tax purposes.

Many ministers voluntarily elect to have churches withhold income taxes from their pay. Most churches are required to withhold income taxes from non-minister employees. Churches can give ministers a Social Security “allowance” or “offset” to help the minister pay SECA taxes. Social Security allowances or offsets are considered as extra income. Ministers will have to report the allowance as income for federal income tax purposes and as income for SECA tax purposes.

Determining a taxpayer’s correct reporting status under the common law employee test is often difficult. The IRS has developed a list of 20 factors to be used as an aid in determining whether an individual is an employee as defined by the IRS. For more information about how the IRS decides if a worker is an independent contractor of employee, see IRS Publication 15-a, Employer’s Supplemental Tax Guide (Supplement to publication 15 (Circular E), Employer’s Tax Guide, on the IRS website at www.irs.gov.

For the most part, ministers are deemed to be common-law employees of the religious organization for which they work, and thus they should receive a W-2 form.

There are only a limited number of instances where a 1099-MISC may be applicable, one of which is if a minister is a traveling evangelist. As this is an easy IRS audit target, a tax preparer must exercise due diligence in ascertaining that a 1099-MISC issued to a minister is appropriate.

The IRS uses a checklist to evaluate whether individuals are independent contractors or employees. If your church controls the “who, where, when and how” of your work schedule, you’re probably an employee for tax purposes.

If you control your work product and have other clients, you’re most likely an independent contractor and should get a 1099 tax form.

There is a reason why the IRS demands a W-2. It is because under a W-2, the minister is not allowed to deduct business expenses on the Federal Income Tax portion of his/her liability except under the limiting reporting of Form 2106. If the minister gets a 1099-Misc, he/she usually deducts 100% of his/her expenses under Schedule C and gets a lower Federal Income Tax bill. Though many ministers do it this way, their chances of getting audited are higher and usually result in payment of back taxes plus penalties.

Oct. 15 Tax Deadline

Oct. 15 Tax Deadline Remains During Appropriations Lapse

The federal tax filing deadline for extension filers is quickly approaching on October 15, 2014. The IRS recently released a reminder of the deadline and some overlooked tax benefits that filers may be able to use:

IR-2014-93, Sept. 30, 2014

WASHINGTON —The Internal Revenue Service today reminded taxpayers that the Oct. 15 deadline remains in effect for people who requested a six-month extension to file their tax return.

The current lapse in federal appropriations does not affect the federal tax law, and all taxpayers should continue to meet their tax obligations as normal. Individuals and businesses should keep filing their tax returns and making deposits with the IRS, as required by law.

Many of the more than 12 million individuals who requested an automatic six-month extension earlier this year have yet to file their Form 1040 for 2012.

Though Oct. 15 is the last day for most people to file, some groups still have more time, including members of the military and others serving in Afghanistan or other combat zone localities who typically have until at least 180 days after they leave the combat zone to both file returns and pay any taxes due. People with extensions in parts of Colorado affected by severe storms, flooding, landslides and mudslides also have more time, until Dec. 2, 2013, to file and pay.

The IRS offered several reminders for taxpayers during the current appropriations lapse:

Taxpayers are encouraged to file their returns electronically using IRS e-file or the Free File system to reduce the chance of errors.

With TruPoint Accounting & Tax your taxes are always free*. Click to start now!

Taxpayers can file their tax returns electronically or on paper. Payments accompanying paper and e-filed tax returns will be accepted and processed as the IRS receives them. Tax refunds will not be issued until normal government operations resume.

IRS operations are limited during the appropriations lapse, with live assistors on the phones and at Taxpayer Assistance Centers unavailable. However, IRS.gov and most automated toll-free telephone applications remain operational.

Tax software companies, tax practitioners and Free File remain available to assist with taxes during this period.

Check Out Tax Benefits

Before filing, the IRS encourages taxpayers to take a moment to see if they qualify for these and other often-overlooked credits and deductions:

Benefits for low-and moderate-income workers and families, especially the Earned Income Tax Credit. The special EITC Assistant can help taxpayers see if they’re eligible.

Savers credit, claimed on Form 8880, for low-and moderate-income workers who contributed to a retirement plan, such as an IRA or 401(k).

American Opportunity Tax Credit, claimed on Form 8863, and other education tax benefits for parents and college students.

Same-sex couples, legally married in jurisdictions that recognize their marriages, are now treated as married, regardless of where they live. This applies to any return, including 2012 returns, filed on or after Sept. 16, 2013. This means that they generally must file their returns using either the married filing jointly or married filing separately filing status. Further details are on IRS.gov.

E-file Now: It’s Fast, Easy and Free

The IRS urged taxpayers to choose the speed and convenience of electronic filing. IRS e-file is fast, accurate and secure, making it an ideal option for those rushing to meet the Oct. 15 deadline. The tax agency verifies receipt of an e-filed return, and people who file electronically make fewer mistakes too.

Everyone can use Free File, either the brand-name software, offered by IRS’ commercial partners to individuals and families with incomes of $57,000 or less, or online fillable forms, the electronic version of IRS paper forms available to taxpayers at all income levels.

TruPoint Accounting & Tax offers free tax preparation to people who generally make $100,000 or less, persons with disabilities, the elderly and limited English speaking taxpayers who need assistance in preparing their own tax returns. Our IRS-certified preparers provide free basic income tax return preparation with electronic filing to qualified individuals.

Taxpayers who purchase their own software can also choose e-file, and most paid tax preparers are now required to file their clients’ returns electronically.

Anyone expecting a refund can get it sooner by choosing direct deposit. Taxpayers can choose to have their refunds deposited into as many as three accounts. See Form 8888 for details.

Of the nearly 141.6 million returns received by the IRS so far this year, 83.5 percent or just over 118.2 million have been e-filed.

Payment Options

Taxpayers can e-pay what they owe, either online or by phone, through the Electronic Federal Tax Payment System (EFTPS), by electronic funds withdrawal or with a credit or debit card. There is no IRS fee for any of these services, but for debit and credit card payments only, the private-sector card processors do charge a convenience fee. For those who itemize their deductions, these fees can be claimed on next year’s Schedule A Line 23. Those who choose to pay by check or money order should make the payment out to the “United States Treasury”.

Taxpayers with extensions should file their returns by Oct. 15, even if they can’t pay the full amount due. Doing so will avoid the late-filing penalty, normally five percent per month, that would otherwise apply to any unpaid balance after Oct. 15. However, interest, currently at the rate of 3 percent per year compounded daily, and late-payment penalties, normally 0.5 percent per month, will continue to accrue.

Fresh Start for Struggling Taxpayers

In many cases, those struggling to pay taxes qualify for one of several relief programs. Most people can set up a payment agreement with the IRS on line in a matter of minutes. Those who owe $50,000 or less in combined tax, penalties and interest can use the Online Payment Agreement to set up a monthly payment agreement for up to 72 months or request a short-term extension to pay. Taxpayers can choose this option even if they have not yet received a bill or notice from the IRS.

Taxpayers can also request a payment agreement by filing Form 9465. This form can be downloaded from IRS.gov and mailed along with a tax return, bill or notice.

Alternatively, some struggling taxpayers qualify for an offer-in-compromise. This is an agreement between a taxpayer and the IRS that settles the taxpayer’s tax liabilities for less than the full amount owed. Generally, an offer will not be accepted if the IRS believes the liability can be paid in full as a lump sum or through a payment agreement. The IRS looks at the taxpayer’s income and assets to make a determination regarding the taxpayer’s ability to pay. To help determine eligibility, use the Offer in Compromise Pre-Qualifier, a free online tool available on IRS.gov.

Details on all filing and payment options are on IRS.gov.

Work cited:

http://www.irs.gov/uac/Newsroom/Reminder:-Oct.-15-Tax-Deadline-Remains-During-Appropriations-Lapse

Most Extreme Tax Deductions of 2015

When it comes to tax season, taxpayers will always try to find ways to get the most money from their refund. Like the time you tried to claim your dog Toby as a dependent. After all, he does “depend” on you as his pet owner, and those dog treats don’t buy themselves. But for some, getting the most may require doing the most extreme deduction possible. Here’s a list of the ten most outrageous deductions of 2015, so far.

1. Ghost Dependents

As it is common for most tax payers to try to claim their pets as dependents, it’s certainly extreme to try and claim an unborn child. The Texas mother who attempted this was not “expecting” the call she received from IRS.

2. A Joyous Occasion

So you got married this year, congratulations! Unfortunately, party-ing it up on the night of your wedding with 250 “business partners” is not actually deductible as entertainment expense.

3. Horseplay & Hobbies

Sorry, but IRS does not deduct hobby expenses. One client learned that fast when he tried to take deductions his horse ranch.

4. Keepin It Up!

Your job may require you to keep up with your appearance when meeting with clients, but a new haircut, surgical procedures, and your stylist expenses are generally not deductible. But you look good though.

5. Having A Home Office

IRS allows deductions only on the portion of the home that is dedicated to the business. Some at home business owners have gone to the extreme trying to claim groceries and even the mortgage.

6. Getaway Trips

Taking your vacation days shouldn’t be a problem. Taking deductions on the vacation you and your co-workers took in Jamaica is a big one for the IRS.

7. Traffic Fines

Running a traffic light on the way to your business meeting can happen, but speeding tickets are fines and therefore, not deductible on your tax return.

8. Misleading Charitable Donations

Indeed, charity can come in many forms. But for one CPA’s client, he learned that vehicles impounded by the police are not deemed as qualifying deductions.

9. Boats

Avoid rough seas with the IRS by not deducting your boat as a “water computer” as one CPA had to enlighten their client.

10. Bad Investments

A loss on a sale of home is unfortunate, and also doesn’t qualify as investment by the IRS therefore, it is not a qualifying deduction.

Have questions on what’s deductible and what’s not? Don’t fall in the same extreme category as these folks. Contact us for more advice.

E-file has begun – Start Today!

It is finally here! Horay!

TruPoint Accounting & Tax has guaranteed high quality service that delivers an immediate return on investment. We have significantly reduced travel face-to-face tax preparations thereby ensuring accuracy, improving productivity and increasing time for you to relax.

File Online with us. Follow 3 easy steps to file your return online and get e-filed in minutes.

We hope you are as excited as we are to OFFICALLY kick off the tax season. The IRS is expecting 150 million individual income tax returns this year, and more than 80% of those will be filed electronically. E-File with direct deposit is the fastest way you can get your tax refund. You can always enjoy the flexibility of paying nothing up front and choosing how you want to receive your tax refund.

Even though e-File is upon us, it’s not too late to start! Register with TruPoint Accounting & Tax today.

Form 3115 and New Tangible Property Regulations (TPR)

It cannot be put off any longer! We have known about the new repairs regulations involving Form 3115. We have had proposed and then temporary guidance that we could choose to follow or not follow. Now the guidance is finalized and complete. Tax years beginning on or after Jan. 1, 2014, must comply with the guidance. Read More…