Where's My Refund? - It's Quick, Easy and Secure

What you need to check the status of your refund:

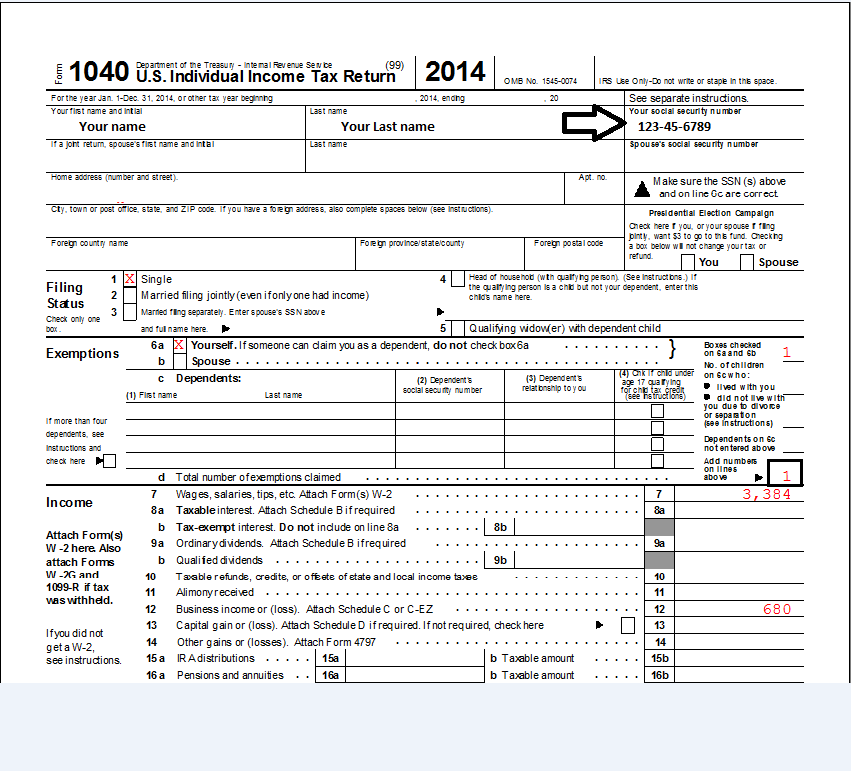

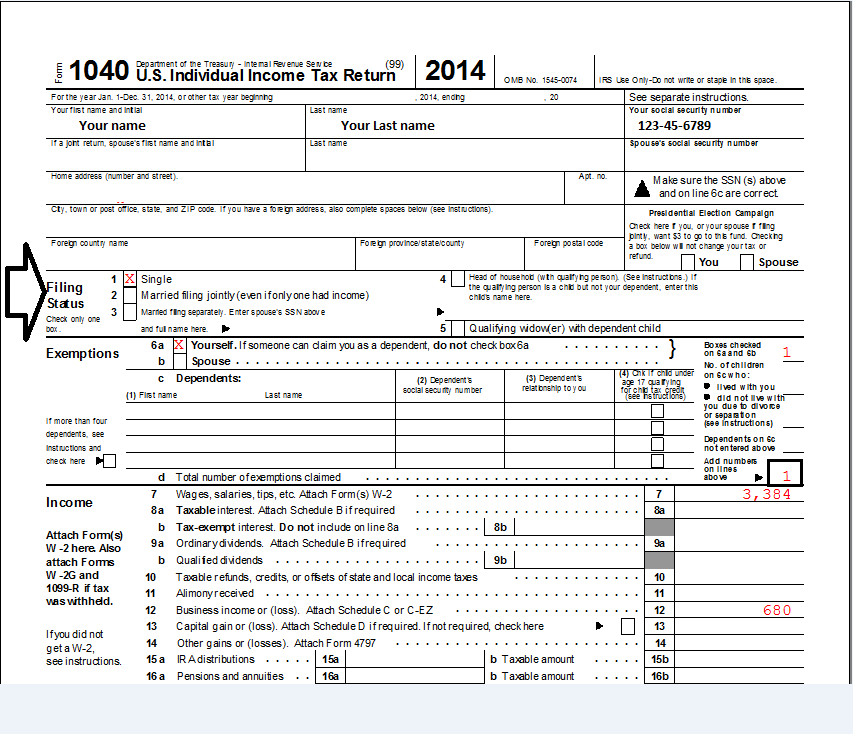

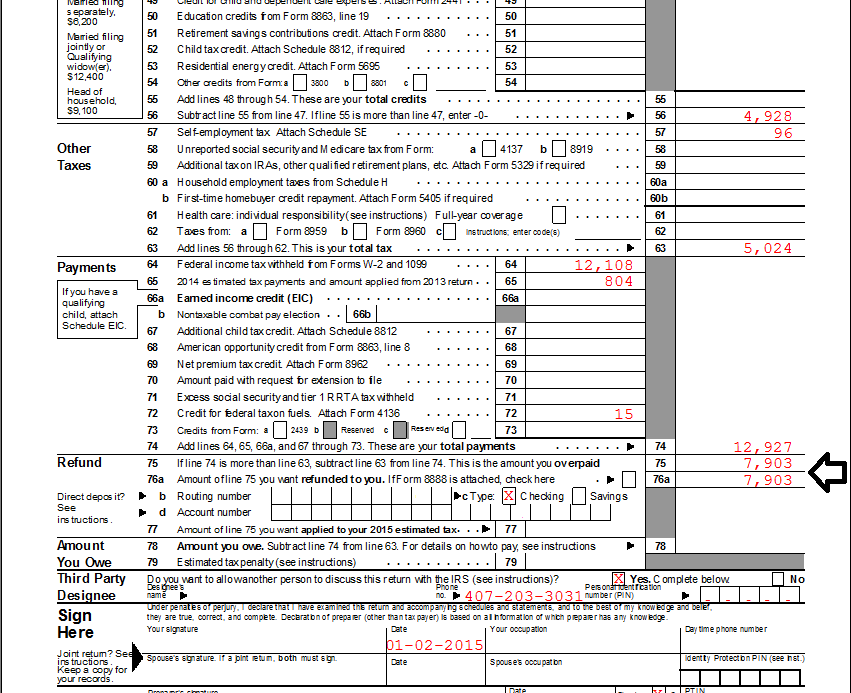

Where to find information on your tax return?

Social Security Number or ITIN

Filing Status

Exact Refund Amount

Where's My Refund? is updated no more than once every 24 hours, usually overnight.When to check status of your refund:

- Within 24 hours after the IRS has received your e-filed tax return; or

- 4 weeks after mailing your paper return.

You should only call if it has been:

- 21 days or more since you filed electronically;

- More than 6 weeks since you mailed your paper return; or

- The Where’s My Refund? tool directs you to contact the IRS.